UNCTAD estimate — up ~21% from 2023, driven by ongoing mining expansion.

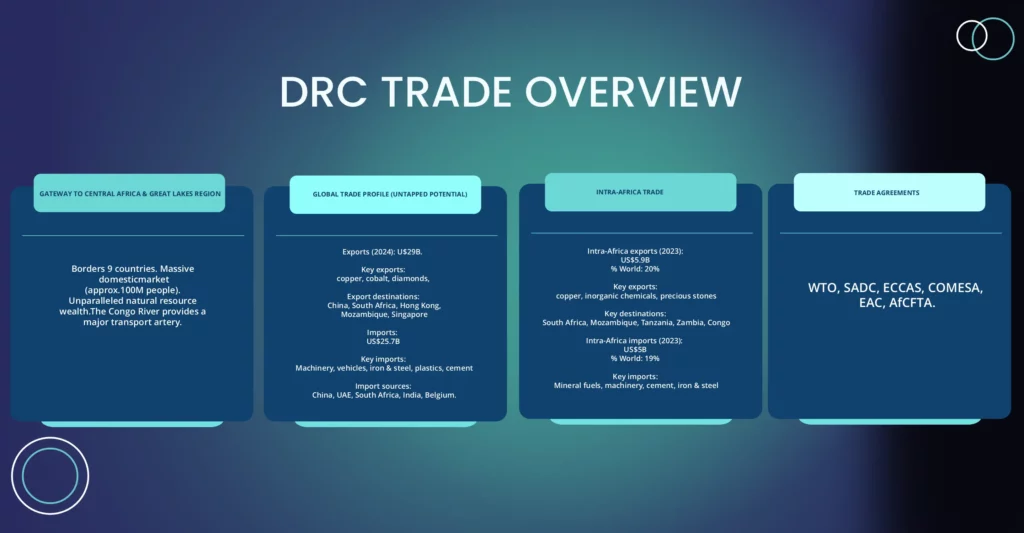

DRC Trade Overview

The Democratic Republic of Congo (DRC) is a vast country with immense, largely untapped economic potential. While it is globally recognised for its unparalleled mineral wealth, the DRC is committed to diversifying its economy and formalising its extensive informal trade networks. With a large population, extensive river systems, and a strategic location that borders nine countries, the DRC has the potential to become a major hub for regional trade in agriculture and manufactured goods. The current focus is on rebuilding infrastructure and developing value chains to convert its resource wealth into broad-based economic growth. Political instability and conflict risk pose serious challenges to such endeavours.

DRC Trade Fact & Figures

(20% World)

(19% World)

Why Trade with the DRC

With a population approaching 100 million, the DRC is one of Africa's largest consumer markets, offering enormous scale for a wide variety of goods and services.

The DRC possesses over 80 million hectares of fertile arable land and abundant water resources, giving it the potential to not only be self-sufficient in food but to be a major agricultural exporter to the rest of the continent.

The DRC's location makes it a natural nexus for trade between Southern, Eastern, Central, and Western Africa. Developing its infrastructure will unlock major new trade routes.

The DRC is the world's largest producer of cobalt and a major producer of copper, materials that are critical for the global green energy transition and electronics industries.

The Congo River, with the construction of the Inga Dam project, has the largest untapped hydroelectric potential in the world, with the potential to power much of the continent and support energy-intensive industries.

The government, with international support, is working to formalise the economy and improve customs and trade procedures, which will create a more predictable environment for international traders.

DRC: Powering Global Trade from the Heart of Africa

The DRC is committed to regional and continental economic integration, leveraging its strategic position through membership in key trade blocs. This framework is designed to lower tariffs, simplify trade rules, and attract foreign investment.

- Global Membership: As a member of the World Trade Organisation (WTO) since 1997, the DRC is provided with a framework for economic reform and greater integration into the global economy, a benefit it is actively leveraging by recently ratifying the Trade Facilitation Agreement to reduce costs and modernise its customs procedures.

- Continental Integration (AfCFTA): The African Continental Free Trade Area (AfCFTA) is a cornerstone of the DRC's policy. Having ratified the agreement, the DRC has validated its national implementation strategy. The focus is now on finalising its tariff reduction offer, which will open access to a market of 1.4 billion people.

Regional Economic Blocs:

- SADC (Southern African Development Community): Provides preferential access to markets in Southern Africa.

- COMESA (Common Market for Eastern and Southern Africa): Offers trade benefits and integration with Eastern and Southern African economies.

- ECCAS (Economic Community of Central African States): Deepens ties with neighbouring Central African nations.

Legal & Business Harmonisation (OHADA): As a member of the Organisation for the Harmonisation of Business Law in Africa (OHADA), the DRC offers a secure, transparent, and modern legal framework for investors and traders, standardizing commercial, corporate, and accounting laws.

The DRC's trade potential is monumental, with a strategic pivot from exporting raw commodities to developing sophisticated manufacturing and processing capabilities. The goal is to capture more value domestically, creating jobs and fostering industrial growth.

Current Trade Snapshot:

- Primary Exports: Dominated by raw minerals, primarily Copper ($15.1B) and Cobalt ($6.3B).

- Key Imports: Refined Petroleum, Machinery, Pharmaceuticals, and Food Products, highlighting a major opportunity for import substitution and local manufacturing.

Focus on Manufacturing & Value Addition:

- The Battery Value Chain Revolution:

- Global Epicentre: The DRC holds over 70% of the world's cobalt reserves and significant lithium deposits.

- DRC-Zambia Battery Council: A landmark partnership with Zambia to develop an integrated value chain, from mining to producing battery precursors and eventually full EV batteries.

- Special Economic Zones (SEZs): A transboundary SEZ is under development with Zambia to house manufacturing plants, creating a "battery belt" in the heart of Africa.

- Harnessing Agricultural Wealth:

- Untapped Potential: Possesses 80 million hectares of arable land and significant water resources yet imports over $1.5 billion in food annually.

- Value Addition Focus: Investment is targeted at processing key crops like coffee, palm oil, cocoa, and cassava for export and local consumption, reducing import dependency.

- Green Energy Manufacturing:

- Hydropower Powerhouse: With over 100,000 MW of potential hydropower, the DRC can power its industrial ambitions and export clean energy.

- Manufacturing Hub: This cheap, abundant energy is a key enabler for energy-intensive manufacturing, including green hydrogen production and minerals processing.

Trade Facilitation: Building the Arteries of Commerce. Recognising that potential is unlocked by efficiency, the DRC and its partners are heavily invested in overcoming logistical hurdles and streamlining the movement of goods.

- Infrastructure Transformation - The Lobito Corridor:

- This strategic rail line is being revitalised with support from the U.S. and the EU.

- It provides a direct, faster, and more reliable route for minerals from the Katanga province to the Port of Lobito in Angola, bypassing traditional, congested routes.

- Impact: Reduces transport time by days, lowers logistics costs, and enhances export competitiveness.

- Streamlining Customs & Border Processes:

- Single Window (GUICE): The Guichet Unique Intégral du Commerce Extérieur acts as a single point of submission for all trade-related documents, aiming to increase transparency and reduce processing times and costs for importers and exporters.

- Border Modernisation: Ongoing efforts to upgrade key border posts with modern technology and harmonised procedures with neighbouring countries to facilitate smoother cross-border trade.

- Addressing Challenges:

- Logistics Performance: While improving, the DRC is focused on enhancing its Logistics Performance Index score by investing in infrastructure, customs efficiency, and logistics service quality.

- Cost of Trade: Efforts are concentrated on reducing non-tariff barriers and informal costs associated with moving goods internally and across borders.

- Regional Tensions: High political and military tensions with neighbouring countries, as recently witnessed, particularly with Rwanda, can escalate into larger conflicts that disrupt regional trade routes and create unpredictable operating environments.

- Conflict in the East: The eastern provinces (like North and South Kivu and Ituri) are plagued by armed conflict involving numerous domestic and foreign armed groups. This poses a direct risk of violence, kidnapping, and loss of life or assets for business personnel.

DRC Trade News

DRC Signs New Regional Trade Agreements to Boost Commerce

Exports from DRC Show Significant Growth in Q1 2025

Major Investments Announced to Improve Trade Infrastructure in DRC

New Trade Finance Programs Support DRC Small Businesses

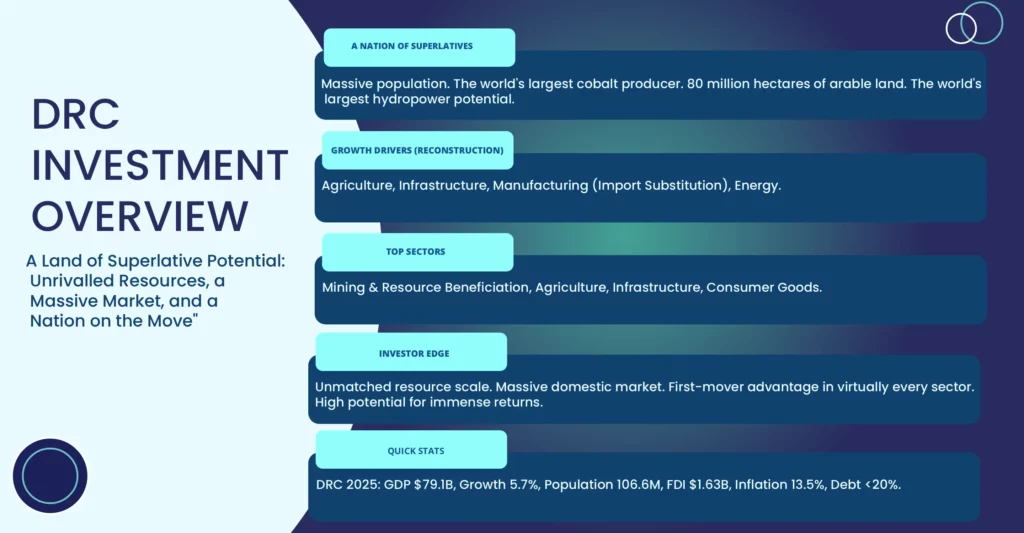

DRC Investment Overview

Investing in the DRC presents a high-risk, high-reward opportunity with exceptional long-term potential. This investment narrative focuses on rebuilding the nation and tapping into one of the world's last great frontier markets. While the mining sector has historically attracted the most foreign direct investment (FDI), the most significant future opportunities lie in foundational sectors such as agriculture, infrastructure, manufacturing, and energy. The government is actively seeking private investment to help unlock this potential, with the National Investment Promotion Agency (ANAPI) serving as the primary gateway for investors.

DRC Investment Facts & Figures

The DRC consistently attracts some of the highest FDI inflows in Africa, driven largely by global demand for copper and cobalt — key inputs for the global energy transition and EV battery supply chains.

Cumulative value of foreign investments, mostly concentrated in the extractive sector.

Share of GDP — among the highest in Africa, reflecting heavy capex in mining mega-projects.

The DRC remains one of Africa’s major FDI destinations, almost exclusively linked to copper & cobalt.

Top Investors (by committed capital, 2019–2023)

- China — large mining consortia and infrastructure-for-minerals arrangements.

- Great Britain (UK) — diversified mining holdings and services.

- Egypt — growing participation in resource-linked and services projects.

- Mauritius — holding structures and regional financial vehicles.

- India — mining, trading and processing value-chain investments.

Based on ANAPI-registered projects; consolidated trends from ANAPI and Lloyds Bank Trade (2023).

Where is the FDI Going? (Top Sectors)

-

Services 44.8% of committed FDI

Logistics, financial services and telecommunications that enable and support the mining industry.

-

Industry 40.7% — Mining-led

Extractive mining (copper, cobalt) plus manufacturing inputs and processing activities.

-

Infrastructure 8.5%

Energy (especially hydroelectric projects) and strategic transport corridors (Lobito, Dar es Salaam).

-

Agriculture 5.9%

A smaller but growing focus on modernising food production and agri-value chains.

Notes: Realised FDI is still overwhelmingly in mining, but committed investment data shows emerging diversification across services, infrastructure and agriculture. Annual and multi-year metrics provide a clearer trend than individual project announcements.

Why Invest in The DRC

Key Investment Sectors in The DRC

Investment Incentives and Support(Facilitated by ANAPI and specific zone regimes)

These incentives support regional development, integration, and competitiveness across Southern Africa in alignment with Malawi's economic cooperation goals.

Tax & Customs Incentives (As per Investment Code & SEZ regulations)

- Exemptions from import duties on machinery, equipment, and inputs. Tax holidays or reduced corporate income tax rates for eligible projects, particularly in SEZs or priority sectors. VAT exemptions. Accelerated depreciation.

Financial & Operational Support

- Access to land, particularly within designated Special Economic Zones (SEZs). Facilitation of work permits for expatriate staff. Guarantees against expropriation. Right to repatriate profits and capital (subject to regulations).

Business Support & Facilitation

- ANAPI as the primary agency for investment promotion, registration, and facilitation. Assistance with obtaining licenses and permits. Support for navigating administrative procedures. GUICE for trade facilitation.

Success Stories

Illustrative examples given the scale of the economy; focus on potential and established niches

Major Copper and Cobalt Mining Operations

Several large international mining companies operate significant copper and cobalt mines in the Katanga region, making the DRC a critical global supplier of these strategic minerals.

Telecommunications Sector Growth

The mobile telecommunications market has seen substantial growth with multiple operators investing heavily in network expansion and services, driving connectivity across the country.

Hydropower Development (Existing & Planned)

Existing Inga I and Inga II dams contribute significantly to the power supply, with ongoing efforts and international interest in developing the larger Grand Inga project.

Investment News

DRC Appoints New CEO to Lead National Economic Council

Kinshasa Hosts Regional Summit on Innovation and the Green Economy

DRC Leads Cross-Border Trade Talks with Angola and Zambia

Strategic Mineral Development Zones Identified Across DRC

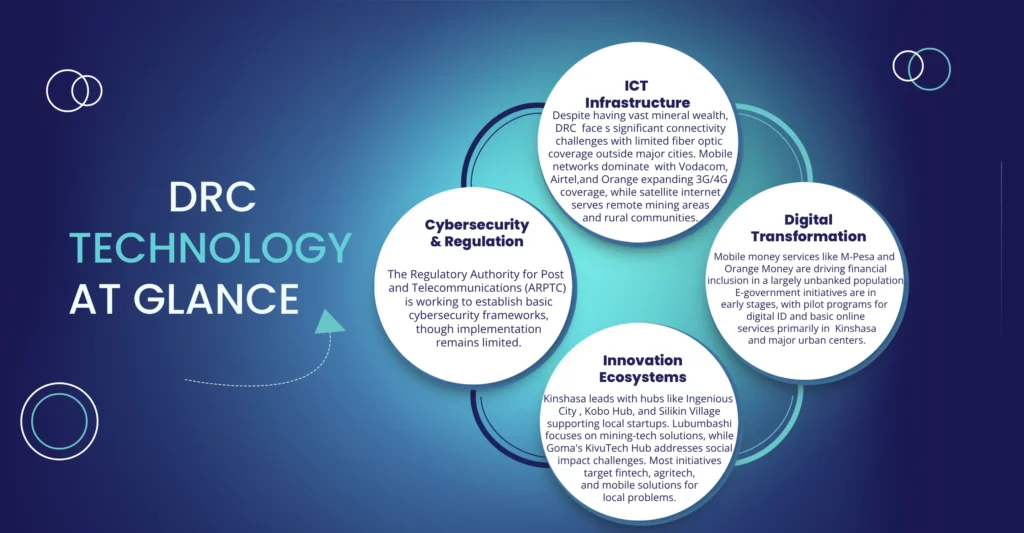

DRC Technology Overview

Investing in the DRC presents a high-risk, high-reward opportunity with exceptional long-term potential. This investment narrative focuses on rebuilding the nation and tapping into one of the world's last great frontier markets. While the mining sector has historically attracted the most foreign direct investment (FDI), the most significant future opportunities lie in foundational sectors such as agriculture, infrastructure, manufacturing, and energy. The government is actively seeking private investment to help unlock this potential, with the National Investment Promotion Agency (ANAPI) serving as the primary gateway for investors.

Technology Facts & Figures

The DRC's technology sector is rapidly emerging, driven by a large, youthful population and increasing mobile connectivity. Kinshasa and Lubumbashi are key centres for tech activity. While challenges in infrastructure exist, the potential for leapfrogging with digital solutions is immense. The government has a National Digital Plan (Plan National du Numérique Horizon 2025) to guide this transformation.

Technology Sectors in The DRC

Leading Technology Hubs & Initiatives

The DRC Technology News

DRC Plans First National AI and Innovation Hub in Kinshasa

Feasibility Study for 5G Rollout Underway in Major DRC Cities

Digital Skills Initiative Targets DRC Youth to Drive Innovation

Fintech Startups Expand Mobile Money Access in DRC

Unlock The Potential Of The DRC

The Democratic Republic of Congo offers vast natural resources and a rapidly growing market with immense potential for businesses involved in international trade. By taking advantage of the FTA benefits and regional economic initiatives, businesses can grow their footprint, improve competitiveness, and support the sustainable development of the region.

Contact Us

Ezekiel Tinashe Mukanga

31 Josiah Chinamano Avenue

Harare, Zimbabwe

📞 +263 777 768 425

✉️ info@sadcsotip.com

🌐 www.sadcsotip.com