Why Trade in South Africa

Advanced Manufacturing Capabilities

South Africa has a deep and diverse manufacturing sector, particularly in automotive production, machinery, and industrial chemicals, making it a key sourcing destination for high-value goods in Africa.

World-Class Infrastructure

The country boasts the most advanced port, rail, and road infrastructure on the continent, ensuring efficient logistics and supply chain management for importers and exporters.

A Hub for Pan-African Commerce

As the continent's financial and commercial capital, South Africa is the natural headquarters and logistics base for companies trading across the African continent.

Sophisticated and Resilient Supply Base

South Africa offers a wide range of high-quality agricultural exports, including world-renowned wine, citrus, and deciduous fruits, supported by a modern commercial farming sector.

Gateway to the Southern African Market

As the anchor of the Southern African Customs Union (SACU), it provides seamless access to the markets of Botswana, Namibia, Lesotho, and Eswatini.

A Large and Dynamic Domestic Market

With a population of over 60 million and a substantial middle class, South Africa is a major market for a wide variety of consumer and industrial goods.

South Africa: A Diversified Gateway for Continental and Global Trade

South Africa pursues a strategic approach to trade policy, intrinsically linked to its national development objectives. The core goal is to support industrial development, create decent jobs, and reduce poverty and inequality by diversifying the economy away from its reliance on traditional commodities.

The policy framework is designed to build domestic industrial capacity through a focus on localisation, beneficiation, and moving up the value chain in key sectors. This involves a “developmental tariff setting” approach, where tariffs are used as an instrument of industrial policy to support downstream, labour-creating manufacturing while ensuring upstream inputs remain competitive.

The strategy also emphasises inclusive growth, with specific programs aimed at integrating small businesses, women, and youth into the economy.

- World Trade Organisation (WTO): As an active member, South Africa is integrated into the global rules-based trading system.

- EU-SADC Economic Partnership Agreement (EPA): In force since 2016, replacing the TDCA trade chapter, and providing enhanced duty-free access for many South African products—including significant quotas for wine, sugar, and ethanol—into the EU market.

- Other Key Agreements: Agreements with the United Kingdom (post-Brexit rollover of EPA terms), the European Free Trade Association (EFTA), and the Southern Common Market (MERCOSUR), negotiated as part of SACU.

- AfCFTA (African Continental Free Trade Area): A landmark opportunity to expand exports of value-added goods and services to new markets in West and North Africa; central to SA’s developmental regional integration agenda.

- SADC: As the region’s largest economy, South Africa is a leader within SADC. The SADC Trade Protocol underpins deep regional integration, with most of SA’s intra-Africa trade occurring within this bloc.

- SACU (Southern African Customs Union): Membership in the world’s oldest customs union allows free movement of goods and a common external tariff; South Africa negotiates international trade agreements as part of SACU.

- InvestSA: Within the dtic, InvestSA is the national investment promotion agency and one-stop shop to attract FDI and streamline investor support.

- Special Economic Zones (SEZs): A robust SEZ programme (SEZ Act, 2014) evolved from IDZs. Zones provide world-class infrastructure and targeted support. Key SEZs: Coega (automotive, agro-processing), Dube TradePort (logistics, manufacturing), East London (automotive), Atlantis (Greentech).

- SEZ Incentives:

- Preferential corporate income tax rate of 15%.

- Building allowances and employment tax incentives.

- Relief from customs and excise duties in Customs Controlled Areas.

South Africa is executing a clear strategy to enhance its industrial base and diversify its export basket. Sector-specific Master Plans (automotive, poultry, clothing) are central to boosting local production and competitiveness.

Current Trade Snapshot:

- Primary Exports: Precious metals/minerals (platinum, gold, iron ore), motor vehicles, coal.

- Key Imports: Mineral fuels (refined and crude), machinery, vehicles, telecommunications equipment.

- Key Trading Partners: China (largest partner), United States, Germany; significant trade within SADC.

- Automotive: The APDP has attracted major global automakers, making vehicles and components leading manufactured exports; SEZs such as Coega and East London are ecosystem anchors.

- Agro-processing: Moving beyond raw exports to processed foods, high-quality wines, and beverages for global markets.

- Mining & Beneficiation: Developing downstream industries to process platinum, chromium, and manganese into higher-value products before export.

- Green Technology: The Atlantis SEZ near Cape Town is developing as a hub for renewable energy component manufacturing.

South Africa has a highly developed network of ports and transport corridors connecting its industrial heartland to global markets and landlocked neighbours.

- Port of Durban: The busiest container port in sub-Saharan Africa; primary gateway for containerised goods and automotive exports.

- Ports of Cape Town & Coega: Cape Town is crucial for agricultural exports with extensive cold storage; Coega (Gqeberha/Port Elizabeth) is a deep-water hub for automotive and bulk trade.

- Maputo Development Corridor: A flagship SDI restoring the trade route between Gauteng/Mpumalanga and the Port of Maputo, catalysing private investment in infrastructure and industry.

- North-South Corridor: High-priority corridor improving the artery from Durban through Botswana and Zimbabwe to the Copperbelt in Zambia and the DRC.

- Customs Modernisation: SARS has undertaken extensive programmes to enhance efficiency, secure supply chains, and facilitate legitimate trade.

- Single Window: A Single Window system is under development to let traders submit all regulatory documents via one online portal, reducing bureaucracy and clearance times.

South Africa Investment Statistics

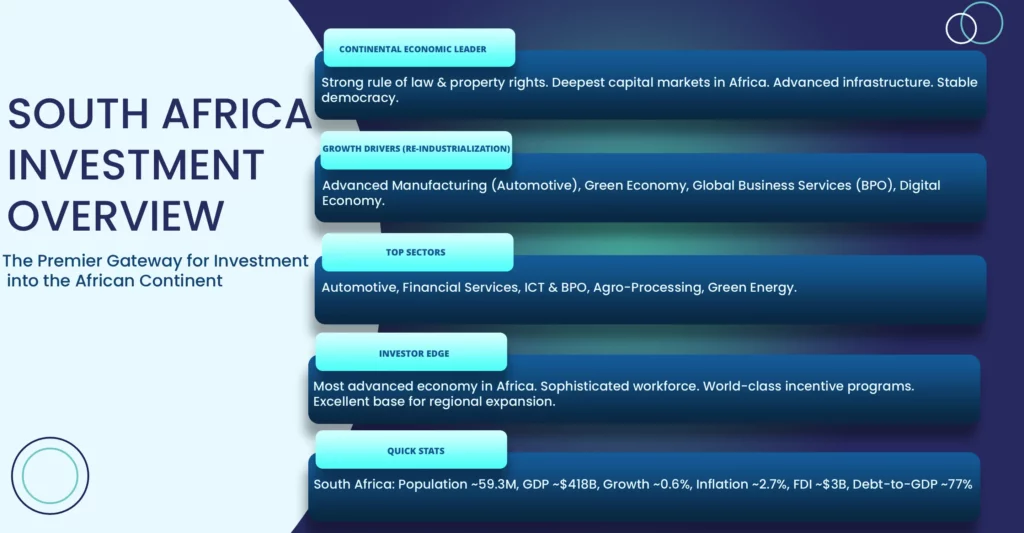

Why Invest in South Africa

The South African automotive industry is a global success story, supported by the government's world-class Automotive Production and Development Programme (APDP), making it a prime location for vehicle and component manufacturing.

The Renewable Energy Independent Power Producer Procurement Programme (REIPPPP) has unlocked billions of dollars in private investment, making South Africa a continental leader in solar and wind energy with vast future potential.

South Africa has emerged as a leading global location for business process outsourcing (BPO), customer service, and technical support, thanks to its large pool of skilled, English-speaking talent and strong government support.

The country's financial markets, banking sector, and legal framework are internationally recognised for their sophistication and integrity, providing a secure and transparent environment for investors.

Hundreds of multinational corporations use South Africa as their headquarters for African operations, leveraging its connectivity, talent, and market depth to manage regional growth.

South Africa has a network of designated SEZs, such as Coega, Dube TradePort, and the Atlantis GreenTech SEZ, which offer world-class infrastructure and specific incentives for targeted industries.

Key Investment Sectors in South Africa

Full vehicle assembly and manufacturing of a wide range of automotive components (catalytic converters, engines, leather seats, wiring harnesses) for global export.

Investment in wind and solar IPPs. Manufacturing of solar panels, wind turbine components, battery storage solutions, and development of the green hydrogen value chain.

Setting up large-scale contact centres and shared service operations for customer support, technical assistance, legal process outsourcing, and finance and accounting services.

Value addition in the wine, fruit (canning, juicing), sugar, and grain industries. Development of high-value food products for domestic and international markets.

Investment in data centres, fibre optic infrastructure, software development, and fintech innovation to serve a large and digitally-savvy population.

Investment Incentives and Support (Facilitated by InvestSA)

These incentives support regional development, integration, and competitiveness across Southern Africa in alignment with Eswatini's economic cooperation goals.

Global Business Services

- Automotive (APDP): Automotive (APDP): Provides import duty rebates and direct cash grants based on the value of local production, creating a highly competitive environment for OEMs and component suppliers.

- Global Business Services (BPO): Offers significant grants per job created for eligible BPO operations serving international clients. .

Tax & Industrial Incentives

- 12i Tax Allowance: A tax incentive supporting investments in manufacturing assets, offering accelerated depreciation allowances.

- SEZ Incentives:A reduced corporate tax rate of 15% (vs. 27% standard), special building allowances, and employment tax incentives for companies located in an SEZ.

Business & Operational Support

- Critical Infrastructure Programme: A cost-sharing grant for projects that require essential infrastructure (e.g., electricity, water, roads) to get off the ground.

Success Stories

Illustrative examples given the scale of the economy; focus on potential and established niches

Global Automotive Powerhouse

Mercedes-Benz, BMW, Ford, Volkswagen, Isuzu, and Toyota all have major manufacturing plants in South Africa, exporting hundreds of thousands of vehicles globally each year under the successful APDP framework.

Leading BPO Destination

Amazon has made South Africa a key node in its global customer service network, employing thousands of people in Cape Town to support clients in North America and Europe, highlighting the strength of the BPO sector.

Renewable Energy Pioneer

The REIPPPP has led to the successful development of over 100 private wind, solar PV, and CSP projects across the country by numerous local and international developers, making it one of the world's most successful renewable energy procurement programs.

South Africa Investment News

Automotive Giants Commit R5 Billion to South Africa’s EV Manufacturing Drive

South Africa Approves 2GW Renewable Energy Projects Under REIPPPP

Global Firms Expand BPO Operations in Cape Town and Durban

Major Data Centre Expansion to Boost South Africa’s Digital Economy

South Africa Technology Statistics

Key Tech Sectors in South Africa

The most advanced fintech market in Africa, with sophisticated solutions in digital payments, lending, insurance (Insurtech), and wealth management. Several South African fintechs have expanded globally.

A large and competitive e-commerce market with major players in online retail, logistics, and digital payment gateways.

A growing sector developing innovative solutions for electronic health records, telemedicine, low-cost medical devices, and health management platforms.

A deep pool of talent developing custom software and Software-as-a-Service (SaaS) products for both local and international clients.

Technology solutions to support the country's large-scale commercial farming sector, including precision agriculture, drone technology, farm management software, and supply chain solutions.

A burgeoning sector focused on technology for managing renewable energy grids, battery storage, energy efficiency, and developing the software layer for the green hydrogen economy.

Leading Technology Hubs & Initiatives

This region is widely regarded as Africa's leading tech hub, hosting the majority of the country's venture capital firms, accelerators like Grindstone, and numerous successful startups and scale-ups.

As the financial capital, Johannesburg is a major centre for fintech innovation and enterprise technology, home to hubs like the Tshimologong Digital Innovation Precinct.

South Africa has the most developed VC ecosystem in Africa, with numerous local and international funds (e.g., Knife Capital, Naspers Foundry, Kalon Venture Partners) actively investing in early-stage tech companies.

A prime example of a tech-focused industrial initiative, this SEZ in Pretoria is designed to co-locate automotive component suppliers with advanced manufacturing technologies to support Ford's regional production hub.

A major private sector-led fund that invests in smaller funds and directly in scalable SMEs, with a significant focus on technology and innovation, helping to deepen the pool of available capital.

South Africa Technology News

South Africa Expands E-Government Services to Improve Service Delivery

Fintech Momentum: Payments, Lending & Insurtech Scale Across SA

Cloud & Data Centre Investments Accelerate South Africa’s Digital Economy

AgriTech Tools Help South African Farmers Boost Yields & Market Access

Unlock The Potential Of South Africa

South Africa is Africa’s most industrialised and diversified economy, strategically located with access to the continent’s largest markets via SACU, SADC, and AfCFTA. Boasting world-class infrastructure, advanced manufacturing capabilities, a strong services sector, and rich natural resources, the country offers exceptional opportunities for investors. Key growth areas include automotive and machinery production, agro-processing, renewable energy, mining beneficiation, tourism, and logistics hubs. Supported by stable financial systems, skilled labour, and progressive trade agreements, South Africa stands as a gateway to the African continent.

Contact Us

Ezekiel Tinashe Mukanga

31 Josiah Chinamano Avenue

Harare, Zimbabwe

📞 +263 777 768 425

✉️ info@sadcsotip.com

🌐 www.sadcsotip.com