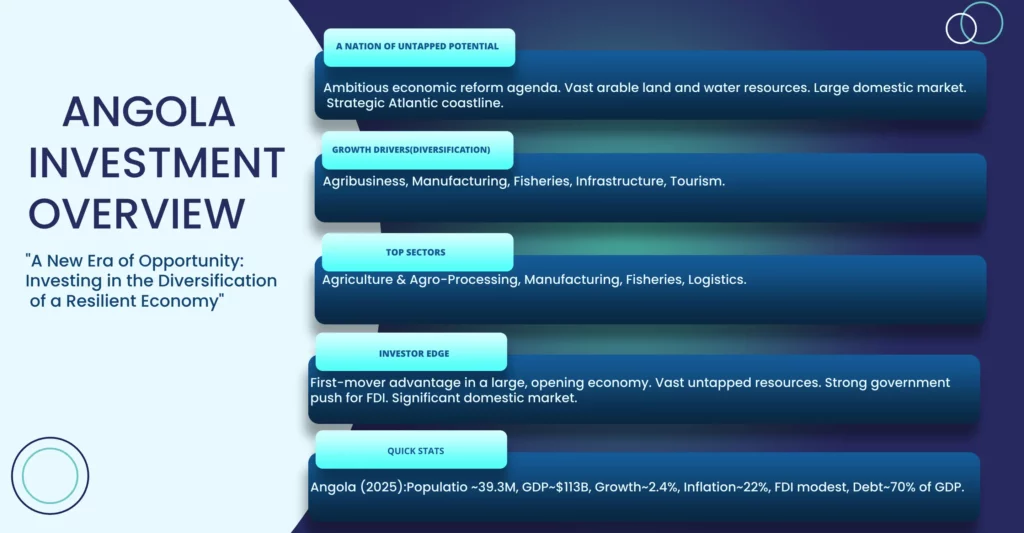

Trade Overview

Angola, one of sub-Saharan Africa's largest economies, is undergoing a profound economic transformation aimed at diversifying away from its historic reliance on oil exports. The country is leveraging its extensive coastline, significant agricultural potential, and strategic location to rebuild its industrial base and enhance its role in regional trade. The focus is on revitalising agriculture, developing the fisheries sector, and investing in infrastructure to facilitate trade in non-oil goods. Angola's ports, particularly Lobito, are being positioned as key gateways to Central Africa.

Why Trade in Angola

With a population of over 35 million, Angola is a significant market for a wide range of consumer and industrial goods, with much of the demand currently met by imports.

The ports of Luanda, Lobito, and Namibe offer strategic access to the Atlantic. The Lobito Corridor, in particular, is a key transport route being rehabilitated to provide a vital trade link for the DRC and Zambia.

Angola has enormous potential to become a major regional supplier of food products. It is already seeing a resurgence in exports like bananas and coffee, with huge room for growth.

Its long Atlantic coastline supports a rich fisheries industry, offering opportunities for sourcing a variety of fish and seafood products.

The government is implementing a wide range of reforms aimed at improving the business climate, simplifying customs procedures, and making it easier to conduct international trade.

As infrastructure improves, particularly the Lobito Corridor, Angola will become an increasingly important gateway for trade with the resource-rich regions of the DRC and Zambia.

Angola: Unlocking a Diversified Gateway for Global Trade

Angola is actively reforming its trade policies to reduce its historic dependence on oil, create a transparent investment climate, and integrate fully with regional and global markets.

- World Trade Organization (WTO): As a member of the WTO since 1996, Angola is integrated into the global rules-based trading system.

- Bilateral Agreements: Angola is actively strengthening economic ties with key partners. It has signed several Bilateral Investment Treaties (BITs) with countries like Germany, Italy, and Portugal, and maintains a strategic Trade and Investment Framework Agreement (TIFA) with the United States to enhance dialogue and deepen commercial relations.

- AfCFTA (African Continental Free Trade Area): Angola has ratified the AfCFTA, and its national implementation strategy is being developed with the support of UNECA. This signals a strong commitment to accessing a continent-wide market and is central to its diversification goals.

- SADC (Southern African Development Community: As a member, Angola benefits from the SADC Trade Protocol, which provides preferential access to a regional market of over 340 million people..

- ECCAS (Economic Community of Central African States): Membership fosters deeper trade ties and stability with its Central African neighbours.

- AIPEX(Private Investment and Export Promotion Agency: This is the key government agency acting as a one-stop shop to attract FDI and support exporters. It is central to implementing the new, more liberal investment framework.

- 2018 Private Investment Law: A landmark reform that removed the requirement for mandatory local partnerships in most sectors, opening the door for 100% foreign ownership and significantly improving the business climate.

- Tariff Policy:A new Customs Tariff Schedule has been implemented, designed to encourage local production and investment in nascent industries by increasing duties on certain finished goods that could be produced domestically

Angola is executing a clear strategy to move from a raw material exporter to a hub for processing and manufacturing, leveraging its rich natural resources far beyond crude oil.

Current Trade Snapshot:

- Primary Export:Overwhelmingly dominated by Crude Oil (approx. 90% of total exports), making economic diversification a national priority.

- Key Imports:Machinery, Vehicles, Food Products (cereals, meat), and Chemicals, revealing significant opportunities for import substitution.

- Agriculture & Agribusiness:

- Untapped Arable Land: Boasts over 58 million hectares of agricultural land, with a focus on reviving key cash crops.

- Value Addition:Moving beyond exporting raw crops to processing coffee, producing cereals, canning tropical fruits, and manufacturing beverages. The goal is to achieve food self-sufficiency and become a major regional food exporter.

- Mining – Beyond Extraction:

- Diamonds: Development of the Saurimo Diamond Development Hub in the east is a strategic priority. The hub is designed to create a domestic industry for cutting and polishing, capturing a far greater share of the diamond value chain than just exporting rough stones.

- Other Minerals: Rich in iron ore, phosphates, and granite, with growing investment in processing these for construction materials and fertilisers.

- Fisheries & Manufacturing:

- Rich Coastal Resources: A 1,600 km coastline offers huge potential. The focus is on increasing the onshore processing of fish and production of high-value fishmeal and oils for export.

- Industrial Growth: Promoting local manufacturing of textiles, footwear, and construction materials to supply the domestic market and reduce reliance on imports.

- The Lobito Corridor: A Regional Game-Changerg:

- This is the most significant trade infrastructure project in the region. It involves a 1,344 km rail line being upgraded and managed by an international consortium with strong backing from the U.S. and EU.

- It provides a fast, secure, and efficient pathway connecting Angola's Port of Lobito to the vast mineral resources of the DRC and Zambia.

- Impact: Slashes transport times and costs, boosts Angolan port volumes, and establishes Angola as the premier gateway for trade between Central/Southern Africa and transatlantic markets.

- Streamlining Trade Processesg:

- National Single Window: The implementation of an electronic single window system is underway. This will allow traders to submit all regulatory documents (for customs, port authorities, etc.) through a single online portal, increasing transparency and dramatically reducing bureaucracy and clearance times.

- Customs Modernisation: Ongoing reforms to align customs procedures with international standards, improving efficiency at ports and land borders.

- Port Development: The deep-water Port of Lobito is being modernised to handle increased cargo volumes efficiently, complementing the railway and solidifying the corridor's strategic advantage.

Angola — Foreign Direct Investment (FDI) Statistics

–$2.12 B

FDI Inflow (Net)

Negative inflow due to oil-sector debt repayments and capital repatriation.

$12.14 B

FDI Stock

Cumulative foreign investment position in Angola.

$7.66 B

Greenfield Announcements

Signals rising confidence, increasingly in non-oil sectors.

25.0%

Gross Capital Formation

Share of GDP, reflecting capital-intensive oil and public infrastructure spend.

Top Investors (by stock / focus)

- 🇳🇱 Netherlands — historic oil investments

- 🇫🇷 France — TotalEnergies & related oil/gas

- 🇨🇳 China — oil, infrastructure & construction finance

- 🇵🇹 Portugal — finance & construction

- 🇧🇷 Brazil — oil & construction

Government policy continues to encourage diversification beyond hydrocarbons.

Where is FDI Going? (Top Sectors)

-

Petroleum (Oil & Gas)

Dominant

Exploration & production — majority of realised stock.

-

Infrastructure & Transport

Lobito Corridor, roads, ports, power.

-

Financial & Insurance

Ecosystem supporting oil & commerce.

-

Manufacturing

Local processing capabilities.

-

Agriculture & Fisheries

Key for diversification & jobs.

Sources: UNCTAD; National Bank of Angola; World Bank; IMF/Lloyds Bank Trade (trends).

Why Invest in Angola

With vast fertile land and abundant water, Angola has the potential to be an agricultural superpower. Investment is critically needed in large-scale commercial farming and, crucially, in food processing to supply the domestic market and for export.

There are significant import substitution opportunities. Investment in manufacturing plants for food and beverages, construction materials, plastics, and other consumer goods can capture a large and growing domestic market.

Invest in modernizing the fishing fleet, developing onshore processing and cold storage facilities, and building an aquaculture industry to serve both local and international demand.

The rehabilitation of the 1,300 km Lobito Corridor rail line to the DRC border is a game-changer. It creates opportunities in logistics, transport services, and industrial development along the entire route.

Angola possesses stunning and diverse natural landscapes, from pristine beaches to dramatic escarpments and national parks. The tourism sector is almost entirely undeveloped, offering enormous potential for investment in hotels, lodges, and tour operations.

The government, via AIPEX, has streamlined the investment process and is actively courting foreign capital with a new, more transparent private investment law.

Investment Sectors in Angola

Large-scale farming of cereals, coffee, fruits, and oilseeds. Investment in sugar mills, flour mills, food processing plants, and meat processing facilities.

Production of cement and other building materials. Food and beverage manufacturing. Assembly of agricultural equipment and consumer goods.

Investment in modern fishing vessels, canneries, fishmeal plants, and the development of large-scale fish and shrimp farming.

Development of industrial parks, particularly along the Lobito Corridor. Investment in logistics, transport, and warehousing to support growing trade.

Revitalizing the cotton-to-garment value chain to supply the domestic market and for potential export.

SADC-Aligned Investment Incentives (Facilitated by AIPEX)

These incentives support regional development, integration, and competitiveness across Southern Africa in alignment with Malawi's economic cooperation goals.

Tax & Customs Incentives

- Tax Credits: Offset up to 50% of capital investment against future tax payments.

- Reduced Tax Rates: Preferential rates for up to 15 years in development zones.

Customs & Repatriation

- Customs Duties: Exemption on capital goods and raw materials for key sectors.

- Profit Repatriation: Guarantees on transferring profits post-tax and project execution.

Business Support & Facilitation

- One-Stop Shop: AIPEX’s Balcão Único assists with project registration and support.

- Help in finding local partners and investment opportunities.

Success Stories

Illustrative examples given the scale of the economy; focus on potential and established niches

Beverage Industry Leader

The Castel Group (Cuca BGI) is a major long-term investor in Angola, operating several large breweries and beverage plants across the country. It is a prime example of a successful import substitution investment, serving a huge domestic market.

Strategic Infrastructure Revival

The Lobito Corridor project, involving the Angolan government, international partners, and private operators, represents a massive investment in infrastructure that will unlock the economic potential of Angola's interior and its land-locked neighbours.

Agricultural Resurgence

Large-scale agricultural projects like Fazenda Biocom are focused on producing sugar, ethanol, and electricity from sugarcane, showcasing a successful revival of the country's agro-industrial potential.

Investment News

Angola Opens New Mining Investment Opportunities Worth $2.5 Billion

International Investors Commit $1.8B to Angola's Renewable Energy Sector

Angola Launches $3B Infrastructure Investment Program for Economic Diversification

Angola Introduces New Tax Incentives to Attract Foreign Direct Investment

Technology Overview

Angola's technology sector is at a pivotal stage of development, with the potential to leapfrog traditional development paths. The rapid growth of mobile penetration and the landing of multiple submarine cables are creating the foundational infrastructure for a digital economy. The government's diversification drive provides a strong impetus for adopting technology to improve efficiency in emerging sectors like agriculture, logistics, and finance. The capital, Luanda, is the centre of a nascent but vibrant startup scene.

Technology Facts & Figures

Key Sectors

This is a sector with explosive potential in a country with a large, young, and underbanked population. Mobile money, digital payments, and agency banking are key areas for growth.

Technology is essential for revitalising Angola's transport corridors. This includes solutions for port management, fleet tracking, and digital platforms to connect cargo owners with transport providers along routes like the Lobito Corridor.

Deploying digital tools to support the revitalisation of the agricultural sector. This includes mobile platforms for farmer extension services, GIS and drone technology for managing large farms, and supply chain solutions.

The government is a key potential client for technology services as it seeks to improve public administration, reduce bureaucracy, and increase transparency through the development of online services.

Opportunities to use technology to deliver health and education services to a large and dispersed population, including telemedicine and online learning platforms.

Angola’s Tech Ecosystem

Luanda is the heart of Angola's tech ecosystem, home to most startups, tech companies, and innovation hubs like Acelera Angola and KiandaHub.

Angola Cables is a key player, managing the nation's international connectivity through submarine cables and operating a large data centre in Luanda, providing essential infrastructure for the digital economy.

Major mobile network operators are key drivers of digital adoption. Their investment in expanding network coverage and developing mobile services is fundamental to the growth of the entire tech ecosystem.

An initiative supported by the government and international partners aimed at accelerating the growth of the local startup ecosystem through mentorship, training, and creating links to investors.

The government's focus on economic diversification includes a digital component, with plans to create a more robust regulatory framework for ICT and promote the use of technology in public and private sectors.

Angola Technology News

Angola Announces $50M Investment in National AI Innovation Hub

Major Telecom Giants Invest $800M in Angola's 5G Infrastructure

Angola Launches $1.2B Digital Economy Investment Initiative

Fintech Revolution: Angola's Mobile Payment Adoption Reaches 65%

Unlock The Potential Of Angola

Angola is rapidly emerging as a major tech hub in Southern Africa, driven by massive infrastructure investments, a young tech-savvy population, and ambitious digital transformation initiatives. With expanding 5G networks, growing fintech adoption, and government-backed innovation programs, Angola presents exceptional opportunities in artificial intelligence, mobile technology, digital banking, and e-commerce. The country's strategic location, abundant natural resources, and commitment to economic diversification make it an ideal destination for tech investors and entrepreneurs looking to tap into Africa's digital revolution.

Contact Us

Ezekiel Tinashe Mukanga

31 Josiah Chinamano Avenue

Harare, Zimbabwe

📞 +263 777 768 425

✉️ info@sadcsotip.com

🌐 www.sadcsotip.com