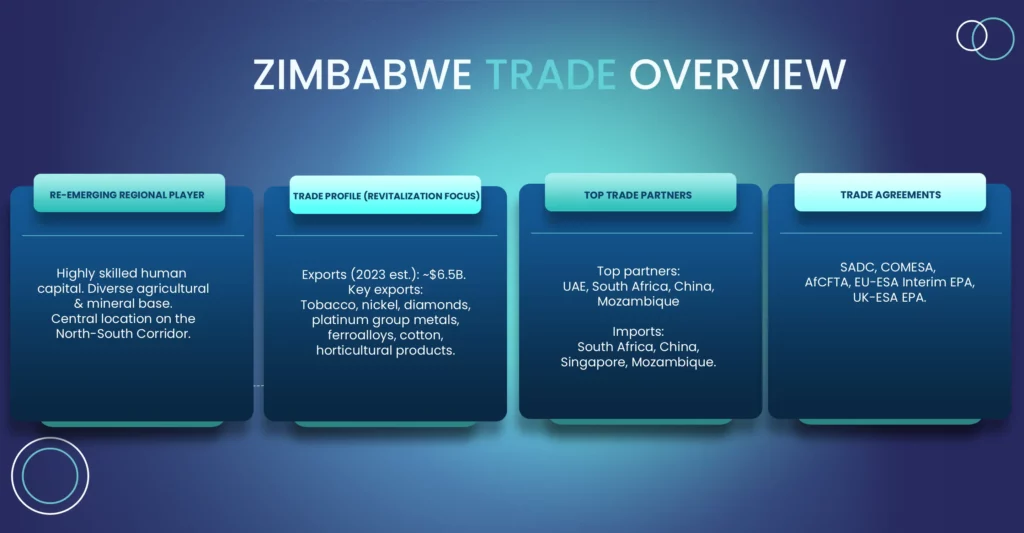

Why Trade in Zimbabwe?

Highly Skilled and Educated Workforce

Zimbabwe has one of the most educated populations in Africa, providing a strong human capital advantage, particularly in manufacturing, services, and commercial agriculture.

Diversified Agricultural Base

Zimbabwe has a long tradition of producing high-quality agricultural products, including flue-cured tobacco, cotton, sugar, and a wide range of horticultural products (flowers, fruits, vegetables) for export.

Significant Manufacturing Potential

Zimbabwe has a strong industrial base capable of producing manufactured goods such as processed foods, textiles, construction materials, and engineering products.

Strategic Location

Zimbabwe is located along the North-South Corridor, a major trade route connecting South African ports with Zambia, the DRC, and beyond, making it a vital transit nation.

Abundant Natural Resources

Zimbabwe has vast mineral resources, enabling opportunities in both raw material exports and processed products like ferroalloys and refined metals.

Growing Regional Integration

Zimbabwe’s membership in SADC, COMESA, and AfCFTA provides preferential market access and opportunities for regional trade growth.

Zimbabwe: Building a Value-Driven Economy

Zimbabwe is pursuing an ambitious "value chain development" approach, aiming to add value to its abundant agricultural and mineral resources before export.

Current Trade Snapshot:

- Primary Exports: The export basket is dominated by primary commodities, including Platinum Group Metals (PGMs), gold, nickel, and unmanufactured tobacco. This heavy reliance on raw materials underscores the national priority to diversify and add value.

- Key Imports: Major imports consist of fuels and petroleum products, machinery, vehicles, and cereals (maize), highlighting needs in energy, industrial equipment, and food security.

- Agriculture & Agribusiness:

- Tobacco Value Addition Plan: While a major tobacco producer, Zimbabwe aims to transform from a 98% raw tobacco exporter to a significant producer and exporter of cigarettes and other finished products, aiming to capture more of the US$1 trillion global tobacco value chain.

- Horticulture: There is a strong focus on reviving and expanding the export of high-value horticultural products like citrus fruits, blueberries, and cut flowers, primarily to European and Middle Eastern markets.

- Mining - Beneficiation as a Priority:

- PGMs & Gold: The core of the mining strategy is local beneficiation. This includes plans for local refining of PGMs and gold to increase export earnings.

- Lithium & Battery Minerals: With some of the largest lithium deposits in Africa, Zimbabwe has banned the export of raw lithium ore to encourage domestic processing and the development of a battery manufacturing value chain.

- Industrial Growth: The NDS1 prioritizes the re-tooling and revitalization of the manufacturing sector, focusing on food and beverage production, textiles, and engineering to supply the domestic market and reduce the import bill.

As a key transit country in the North-South Corridor, Zimbabwe is undertaking major projects to improve trade facilitation, reduce transport costs, and enhance the efficiency of its transport corridors.

- Beitbridge Border Post Modernisation: This is the flagship trade facilitation project. The border with South Africa, one of the busiest in Africa, has been comprehensively upgraded and modernized into a state-of-the-art One-Stop Border Post (OSBP). This has drastically reduced truck turn-around times from days to hours, streamlining the flow of goods along the North-South Corridor.

- Transport Corridors: Zimbabwe is a key component of several regional corridors:

- The North-South Corridor connects South Africa's ports to Zambia, DRC, and beyond.

- The Beira Corridor provides the most direct sea route for Zimbabwe's eastern regions to the Port of Beira in Mozambique.

- Impact: These upgrades and the efficient management of corridors are critical for reducing logistics costs and enhancing the competitiveness of Zimbabwean products.

- National Single Window: The government is in the process of implementing a National Single Window system. This electronic platform will integrate all cross-border regulatory agencies, allowing traders to submit documentation online through a single portal, thereby increasing efficiency and transparency.

- Customs Modernisation: The Zimbabwe Revenue Authority (ZIMRA) has implemented various customs modernisation programs, including the use of electronic systems for cargo tracking and customs clearance, to facilitate legitimate trade and enhance compliance.

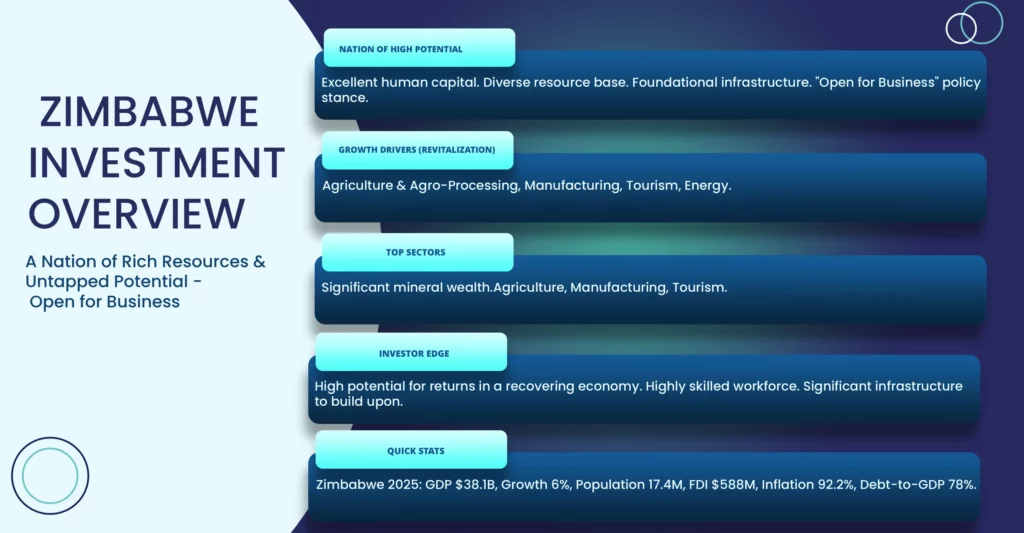

Investment Facts & Figures

$342M

FDI Inflows

Estimated annual foreign direct investment (UNCTAD, 2023 est.)

3.6%

GDP Growth

Projected real GDP growth rate for 2025 (AfDB, IMF)

61%

Young Population

Population under 25 years old (UN Population Division)

Why Invest in Zimbabwe

There are immense opportunities to invest in rebuilding Zimbabwe's agricultural prowess, particularly in tobacco processing, horticulture (for the European market), and large-scale grain and livestock production.

With its existing industrial infrastructure and skilled labour, there is significant potential to invest in retooling and modernising factories to produce goods for the domestic and regional markets, presenting major import substitution opportunities.

Zimbabwe is home to the spectacular Victoria Falls, Great Zimbabwe, and numerous world-class national parks like Hwange and Mana Pools. The tourism sector has enormous potential for recovery and growth.

Significant investment is needed to upgrade the country's road, rail, and energy infrastructure, creating major opportunities for investors in construction, engineering, and power generation.

The establishment of ZIDA is a clear signal of the government's intent to simplify and promote investment, providing a single point of contact for licensing, permits, and incentives.

The government has designated SEZs in key locations, including Victoria Falls (tourism), Bulawayo (manufacturing), and Harare (tech), which offer special incentives for new investors.

Key Investment Sectors in Zimbabwe

Investment in tobacco auctioning and processing. Expansion of horticultural production (flowers, fruits) and packing houses. Revitalization of the beef and dairy industries.

Retooling existing factories for food processing, textiles, and clothing. Production of construction materials, chemicals, and pharmaceuticals.

Building and upgrading hotels, lodges, and conference facilities in Victoria Falls and other tourist hubs. Investment in tour operations and conservation activities.

Refurbishment of existing power stations and investment in new renewable energy projects, particularly large-scale solar farms.

Public-Private Partnerships (PPPs) in the rehabilitation of road and rail networks, water and sanitation systems, and ICT infrastructure.

Investment Incentives and Support (Facilitated by EIPA)

These incentives support regional development, integration, and competitiveness across Southern Africa in alignment with Eswatini's economic cooperation goals.

SEZ Incentives

- Tax Holidays: A five-year tax holiday on corporate income tax for operations within a designated SEZ

- Duty Exemptions: Exemption from customs duties on imported capital equipment, raw materials, and intermediate goods. .

- Capital Allowances:Accelerated depreciation rates (Special Initial Allowance) on capital equipment, allowing for rapid write-offs.

General Incentives

- Non-Resident Tax: Exemption from non-resident withholding tax on dividends for investors in the SEZs.

- Duty-Free Imports: Capital goods and raw materials for export production are exempt.

Business & Operational Support

- Investment Guarantees: The ZIDA Act provides legal protection against expropriation and guarantees the right to repatriate profits and dividends.

- One-Stop Investment Services Centre: ZIDA provides a single interface for investors to handle all necessary permits, licenses, and company registration requirements.

Success Stories

Illustrative examples given the scale of the economy; focus on potential and established niches

Resilient Tobacco Sector

The tobacco sector remains a resilient pillar of the economy. Large international merchants have continued to invest in contract farming schemes and processing facilities, making it the country's largest single agricultural export earner.

Diversified Food Processing

Innscor Africa Limited is a major Zimbabwean success story. Starting as a fast-food outlet, it has grown into a massive, diversified conglomerate with interests in food processing (milling, bakeries), consumer goods manufacturing, and retail.

Beverage Market Leader

Delta Corporation, a long-standing blue-chip company and an associate of AB InBev, is a dominant player in the beverage market. It has continued to invest in its production facilities and distribution network, demonstrating long-term confidence in the domestic market.

Zimbabwe Investment News

Major Agribusiness Firms Eye Zimbabwe's Horticulture & Tobacco Sector

Government Launches $200M Manufacturing Retooling Initiative

Victoria Falls to Receive $150M in New Hotels & Tourism Facilities

Zimbabwe Approves 500MW Solar Farm Projects to Boost Energy Security

Zimbabwe Technology (ICT) Statistics

Key Sectors in Zimbabwe

This is the most developed and innovative tech sector in Zimbabwe. Companies are creating sophisticated solutions for mobile payments, cross-border remittances, and digital banking in a multi-currency environment.

There is a huge opportunity to deploy technology to revitalize the agricultural sector. This includes farm management software, drone technology for crop assessment, and digital platforms to connect farmers to markets and financing.

Developing digital solutions to improve healthcare delivery, such as electronic health records, telemedicine, and platforms for managing medical supplies.

Leveraging the country's strong educational foundation to create digital learning content and platforms to enhance skills development and expand access to quality education.

There is significant potential to build an IT outsourcing industry by leveraging the country's highly skilled but cost-competitive English-speaking workforce for software development, data analytics, and other services.

Leading Technology Hubs & Initiatives in Zimbabwe

Harare is the heart of Zimbabwe's tech ecosystem, hosting the country's leading innovation hubs like Impact Hub Harare and Moto Republik, as well as most software development companies.

A pioneering Zimbabwean technology company. Its subsidiaries, including Econet Wireless (telecoms) and Cassava Smartech (fintech), have been instrumental in building the country's digital infrastructure and driving the adoption of mobile money (EcoCash).

The Zimbabwe Investment and Development Agency recognizes ICT and tech innovation as a priority area and is working to create a more supportive environment for tech startups and investors.

Despite challenges, Zimbabwe has a strong and active community of software developers and tech professionals who are globally competitive and actively engaged in building local solutions.

The establishment of this US dollar-denominated stock exchange is partly aimed at making it easier for technology companies and other growth-oriented businesses to raise capital from international investors.

Zimbabwe Technology News

Zimbabwe Expands E-Government Services to Boost Public Sector Efficiency

Fintech Growth in Zimbabwe: EcoCash and Startups Drive Financial Inclusion

Zimbabwe Invests in ICT Infrastructure to Strengthen Digital Economy

AgriTech Innovation Helps Zimbabwe Farmers Access Global Markets

Unlock The Potential Of Zimbabwe

Zimbabwe sits at the heart of Southern Africa with access to SADC, COMESA, and AfCFTA markets. A strong base in agriculture and mining (PGMs, gold, lithium), a skilled workforce, and active reforms led by ZIDA create a compelling environment for investors. From value-added agro-processing and competitive manufacturing to tourism, energy, and infrastructure renewal along key regional corridors, Zimbabwe offers high-impact opportunities backed by improving logistics, special economic zones, and investor-friendly policies.

Contact Us

Ezekiel Tinashe Mukanga

31 Josiah Chinamano Avenue

Harare, Zimbabwe